Governance

The Board

The Board of Just Life Group (JLG) has been appointed by the shareholders to guide and monitor the business of the Group and is responsible for the overall corporate governance of the Group.

The Board is committed to ensuring that the Company adheres to the best practice governance principles and maintains the highest ethical standards. The best practice principles which the Company considers in its governance approach are the New Zealand Exchange (NZX) Listing Rules and the NZX Corporate Governance Code (the “Principles”).

Composition

The board represents an appropriate mix of skills, expertise and independence to represent the shareholders’ interests.

- Tony Falkenstein is the CEO, an Executive Director and Founder of Just Life Group.

- Phil Norman is the Chair, an Independent Director, and a member of both the Audit and Risk Committee and the People and Culture Committee.

- Richard Carver is an Independent Director, Chair of the Audit and Risk Committee, and a member of the People and Culture Committee.

- Lynne Jacobs is a Non-executive Director and the Chair of the People and Culture Committee.

- Steve Bayliss is an Independent Director and a member of both the Audit and Risk Committee and the People and Culture Committee.

Responsibilities

The function of the Board includes responsibility for:

- the direction, development and approval of corporate strategies and the annual budget

- monitoring financial performance including approval of the annual and half-year financial reports, and liaison with the Company’s auditors

- ensuring effective management of the Company’s assets

- ensuring the Company complies with all health and safety responsibilities arising from the conduct of its business operations

- appointment of and assessment of the performance of the CEO

- monitoring managerial performance

- ensuring the business risks facing the Company have been identified and that adequate control, monitoring and reporting mechanisms are in place.

Board meetings are generally held quarterly, with additional meetings as required.

The Board has an Audit and Risk Committee and a People and Culture Committee. These committees do not take action or make decisions on behalf of the Board unless specifically mandated to do so by express prior board authority.

The listed company is subject to the rules detailed in the shareholder approved constitution. A copy of the constitution is available for inspection on the Companies Office’s electronic register .

Audit and Risk Committee

The Audit and Risk Committee is comprised solely of independent and non-executive directors and the chair of the committee is also an independent director.

The function of the Audit and Risk Committee is to:

- assist the Board in carrying out its responsibilities under the Companies Act 1993, the Financial Markets Act 1993 and the Financial Markets Conduct Act 2013 in respect of the group financial accounting practices, policies and controls

- to review and make appropriate enquiry into the audit of the Group financial statements

- ensure a particular focus on the qualitative aspects of financial reporting to shareholders, on processes for the management of business and financial risk, and for compliance with significant applicable legal, ethical, health and safety and regulatory requirements

- co-ordinate with other Board committees and maintain strong, positive working relationships with management, external and internal auditors, counsel and other committee advisors.

In line with the Principles, the Audit and Risk Committee currently comprises:

- solely of non-executive directors, a majority of which are independent directors

- at least one director who is a chartered accountant

- Richard Carver is Chair, an independent director and is not the Chair of the Board.

The Audit and Risk Committee operates within the framework of the Audit and Risk Committee Charter.

People and Culture Committee

The objective and purpose of the People and Culture Committee is to assist the board in establishing coherent remuneration policies and practices which:

- enable the Company to attract, retain and motivate executives and directors who will create value for shareholders

- fairly and responsibly reward executives having regard to the performance of the group, the performance of the executive and the general remuneration environment

- comply with the provisions of the NZX Listing Rules and any other relevant legal requirements.

Recognising the key role personnel play in the pursuit of the Group’s strategic objectives, the committee is responsible for determining the remuneration of the CEO, and for maintaining an overview of the remuneration of senior management.

In performing these roles, the committee operates independently of the Group’s senior management, and where required, obtains independent advice on the appropriateness of the remuneration and related packages that fall within its responsibility.

The fees payable to non-executive directors are determined by the People and Culture Committee, with the current total maximum remuneration payable to the directors of the Group being $200,000 per annum as approved by ordinary resolution at the 2018 annual meeting of shareholders.

The Chair of the People and Culture Committee is Ian Malcolm, an independent director.

The People and Culture Committee operates within the framework of the People and Culture Committee Charter.

Reporting and Continuous Disclosure Obligations

The directors are committed to ensuring integrity and timeliness in their financial reporting and in providing information to the market and shareholders which reflects a considered view on the present and future prospects of the Group.

Continuous disclosure obligations of NZX require all listed companies to advise the market of any material events and developments as soon as the directors become aware of them. The Group has policies and a monitoring programme in place to ensure that it complies with these obligations on an ongoing basis and ensures timely communication of material items to shareholders via the NZX and directly, as appropriate.

Risk Management

The Group has a risk management plan in place to identify and address areas of significant business risk. Risk management is carried out by the Board with responsibility delegated to the Audit and Risk Committee. The Audit and Risk Committee identifies and evaluates financial risks in close cooperation with the Group’s operating units.

The Board provides principles for overall risk management, as well as policies covering specific areas, such as foreign exchange risk, interest rate risk, credit risk, use of derivative financial instruments and non-derivative financial instruments, and investment of excess liquidity that are designed to:

- optimise the return and protect the interest of the Group stakeholders

- safeguard the Group’s assets and maintain its reputation

- improve the Group’s operating performance

- fulfil the Group’s strategic objectives.

Health and Safety

The Board has approved a Health and Safety Charter which provides a framework for the culture and compliance with health and safety best practices by the Group.

Each member of the Board exercises due diligence to ensure that the Group complies with its health and safety duties under the relevant legislation, ensures management has clear guidance regarding health and safety responsibilities and accountabilities and monitors the Group’s and management’s performance according to key health and safety indicators.

Investor Relations

The Group values its dialogue with institutional and private investors and is committed to giving all shareholders comprehensive, timely and equal access to information about its activities.

The Board aims to ensure that shareholders receive all information necessary to assess the Board’s performance. They do so through a communication strategy which includes:

- periodic shareholder newsletters;

- periodic and continuous disclosure via announcements to the NZX;

- regional shareholder meetings with directors and executive management;

- information provided to analysts and media;

- annual and half-yearly reports distributed to all shareholders;

- the annual shareholders’ meeting; and

- information provided on the group’s website.

In accordance with the New Zealand Companies Act and NZX Listing Rules, the Group is no longer required to automatically mail a hard copy of its annual or half-yearly reports to shareholders.

These reports will be available electronically; however shareholders can request a hard copy of the report to be mailed to them free of charge.

The notice of meeting is circulated at least 10 days before the meeting and is also posted on the Group’s website. Shareholders are provided with notes on all the resolutions proposed through the notice of meeting each year. Directors are available at the annual shareholder meetings to answer shareholder questions. The Board encourages full participation of shareholders to ensure a high level of accountability and identification with the Group’s strategies and goals.

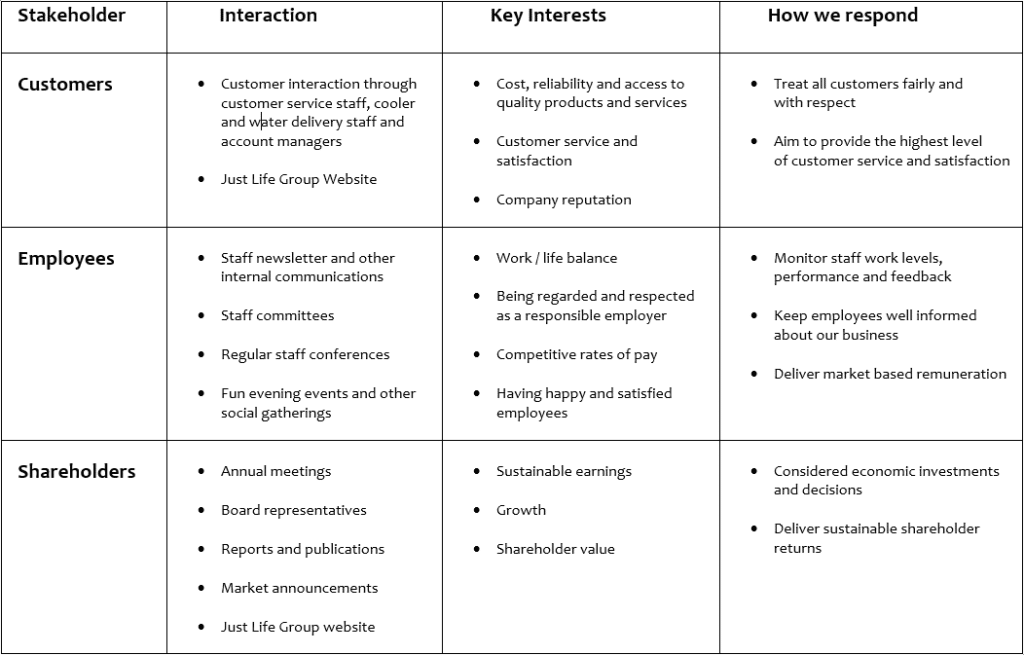

Stakeholder Interests

Just Life Group aims to manage its business in a way that will produce positive outcomes for all stakeholders including the public, our customers, team members, suppliers and shareholders.

The intention is to monitor progress towards business sustainability as we seek to assess and actively improve the social and environmental characteristics of the business.

The Group is strategically committed to this goal and endeavors to integrate it more fully into its day-to-day operations.

Here’s how we interact with our key stakeholders.